The crypto market experienced a boost today, with total market capitalisation increasing by about 1% over the last 24 hours, reaching $2.13 trillion on Aug. 23. This growth includes modest gains in Bitcoin and Ether, which rose by approximately 1.03% and 0.05%, respectively. The recent Federal Reserve minutes supported expectations of a rate cut next month, with the “vast majority” of policymakers indicating that a September cut could be appropriate if the data aligns with expectations. Technically, the market’s gains today continue a rebound from a critical support confluence at $1.86 trillion, coinciding with the support line of an ascending triangle. This rally extended across major tokens such as BNB, XRP, Dogecoin, Uniswap, Polkadot, Polygon, Chainlink, and Shiba Inu, which saw increases of up to 11%. Stablecoins dominated trading activity, accounting for $54.9 billion, or 92.67% of the total crypto market’s 24-hour volume, according to the latest data.

Between Aug. 21 and Aug. 22, Bitcoin saw a 4% gain, holding firm above the $60,000 support level despite a slight loss in momentum. Analysts suggest that breaking the $62,000 resistance is key to confirming a bullish trend. However, with the market anticipating expansionary measures from the United States Federal Reserve (Fed), the outlook remains favourable for Bitcoin bulls in the medium-term. Investors continue to maintain a positive stance but see no immediate catalyst to narrow the gap between Bitcoin and traditional markets. Bitcoin is still grappling with its identity as an uncorrelated asset with multiple uses. For instance, global gold ETFs manage $246.2 billion in assets, while spot Bitcoin instruments, including ETFs and ETNs, manage $66.6 billion, according to CoinShares. Despite Bitcoin’s unique attributes, such as censorship resistance and a fixed monetary policy, it still has significant ground to cover in establishing itself within traditional financial markets.

Ethereum [ETH] has been struggling within a prolonged downtrend, with its price confined to the $2,550-$2,730 range for nearly two weeks. A deeper look into the market revealed that Ethereum users are, increasingly, favouring private transactions, which consume more gas and contribute to base fee volatility, potentially disadvantageous to network users. Since August 18, Open Interest for Ethereum has fluctuated in tandem with its price, highlighting uncertainty and a lack of conviction in the futures market. Although the funding rate has recently turned positive, indicating that speculators are leaning towards long positions, this shift is not a definitive bullish signal. Despite broader outflows in the ETH ETF category, BlackRock’s iShares Ethereum Trust (ETHA) has notably crossed the $1 billion net inflow mark.

The US Dollar Index (DXY), which measures the USD’s performance against major global currencies, has dropped 3.68% from its July 30 high of 104.34 to a low of 100.50 on August 22, marking its lowest level in 2024. This decline coincides with a significant revision from the US Bureau of Labor Statistics (BLS), which adjusted the 12-month job growth figures downward by 818,000 jobs. This adjustment reveals that from April 2023 through March 2024, payrolls were overstated by an average of 68,000 jobs per month. The revised data suggests that the US labour market is weaker than initially reported, increasing expectations that the Federal Reserve may soon ease its monetary policy.

Technical Outlook:

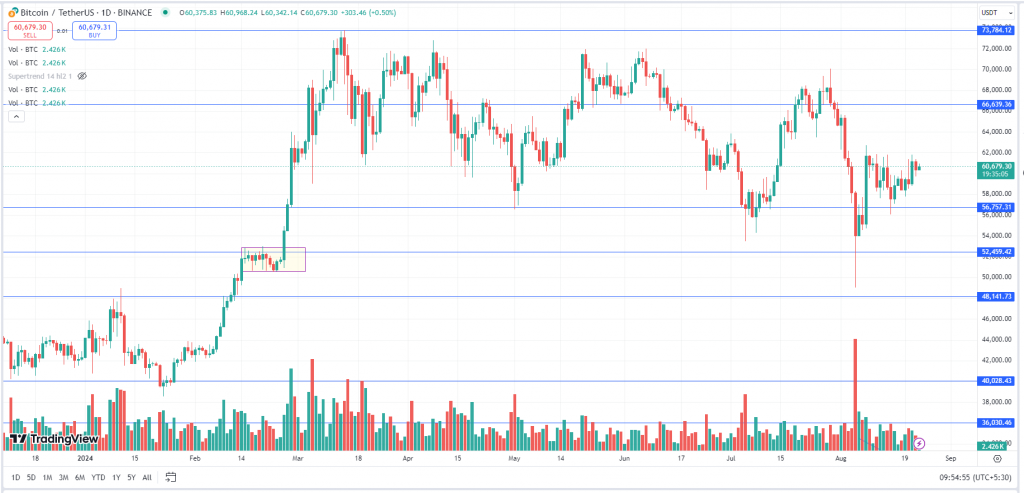

BITCOIN:

Bitcoin continued to struggle to sustain above the $70K mark as the prices corrected almost by 25% and made a low of $49,000. However, the asset didn’t give a daily closing below the key support of $52,500, and the lower longer shadow around $50K indicated buying and it ralling up to $62,745. Currently, BTC is trading sideways in a range from $57,500 to $62,000 with low volumes. Breakouts on either side of the range with good volumes will further decide the trend for the asset.

ETH:

ETH had taken multiple support at $2,150 and this time too, it bounced from the same key support level of $2,150 and rallied up to $2,780. Post this move, the asset is consolidating and is trading sideways in a range from $2,750 to $2,500 with declining volumes. Breakout on either side of the range with good volumes will further decide the trend for ETH.

BNB:

BNB after making the new all time high of $721 witnessed a sharp correction as it failed to give a weekly close above the previous all time high of $691. The prices corrected almost by 44% and dropped to $400. The asset has bounced back above $500 and made a weekly high of $590 but with low volumes. BNB has a strong resistance at $600 and to further rally, it needs to break, close, and sustain above $600.

Weekly Snapshot:

| USD ($) | 15 Aug 24 | 22 Aug 24 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $57,560 | $60,382 | 4.90% | $61,779 | $56,162 | $61,834 | $57,110 |

| ETH | $2,570 | $2,623 | 2.06% | $2,775 | $2,513 | $2,696 | $2,539 |

| BNB | $519.87 | $583.05 | 12.15% | $535.54 | $500.18 | $589.42 | $511.04 |

| Crypto Asset | 1w – % Vol. Change (Global) |

|---|---|

| Bitcoin (BTC) | -12.89% |

| Ethereum (ETH) | -29.89% |

| Binance Coin (BNB) | 7.98% |

| Resistance 2 | $66,000 | $3,000 | $1.00 | $635 |

|---|---|---|---|---|

| Resistance 1 | $62,500 | $2,750 | $0.75 | $600 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $56,000 | $2,450 | $0.6 | $545 |

| Support 2 | $52,000 | $2,150 | $0.5 | $500 |

Market Updates:

- SOS Limited, a blockchain-based service solution provider, has received a noncompliance letter from the New York Stock Exchange (NYSE) due to underperforming stock prices. The trading price of its American depositary shares (ADSs) has dropped below $1 over a consecutive 30-trading-day period.

- Asset manager Grayscale Investments launched a new investment fund for Avalanche’s native token, AVAX, according to an Aug. 22 announcement.

- India’s Department of Economic Affairs’ consultation paper is expected to be a watershed moment for crypto regulation in the country, potentially setting the stage for future legislation.

In the grand scheme of things, ZebPay blogs is here to provide you with crypto wisdom. Click on the button below and discover endless features on ZebPay!