The crypto market experienced a significant decline on July 25th, triggered by an unexpected sharp sell-off that led to a wave of liquidations in the derivatives market. The total market capitalization dropped by over 3.5% to around $2.31 trillion. This plunge has left many market participants questioning the underlying causes and the potential duration of this decline. The crypto market’s sell-off mirrors the weakness seen in US equities, with the US stock market losing a staggering $1.1 trillion in valuation over the last 24 hours. Investors remain cautious about the potential impact on the Federal Reserve’s monetary policy. While the Federal Open Market Committee (FOMC) is set to meet on July 31, expectations for rate cuts in July remain low.

After briefly touching the $68,000 mark on July 22, Bitcoin underwent a 6% correction over the next three days, wiping out the gains from the previous week. On the bullish side, the $64,000 support level held strong, signalling resilience. Buyers intervened to protect Bitcoin’s market capitalization at $1.25 trillion, which is slightly higher than the British pound’s valuation of $1.15 trillion. However, in the short term, Bitcoin bears can leverage supportive macroeconomic data to their advantage. Bitcoin’s recent price drop mirrors the Nasdaq index futures, which saw a 4.9% correction between July 23 and July 24. This correlation prompts traders to consider whether the factors driving the stock market’s decline, particularly in tech sectors, also impact the crypto market. If the primary concern is fear of an economic recession, Bitcoin’s long-term potential could present a compelling buying opportunity for investors.

ETH’s price has dropped by approximately 8.75% in the past 24 hours, settling around $3,170 on July 25. This decline came on the heels of the launch of eight spot Ether ETFs on the New York Stock Exchange, erasing nearly two weeks of previous gains and indicating a “sell-the-news” reaction in the Ethereum markets. The newly launched US-based spot Ether exchange-traded funds (ETFs) experienced outflows on their second day of trading, with a net outflow of $133.3 million, according to data from Farside Investors. These new Ethereum investment products were further impacted by substantial selling from the recently converted Grayscale Ethereum Trust (ETHE), which saw outflows of $326.9 million. On July 24, seven of the eight spot ETH ETFs posted net inflows, with Fidelity’s Ethereum Fund (FETH) and the Bitwise Ethereum ETF (BITW) leading the way, recording $74.5 million and $29.6 million in new flows, respectively.

Recent macroeconomic data has further dampened investor sentiment. The United States economy grew at an annualized rate of 2.8% in the second quarter, surpassing the market consensus of 1.9%. Additionally, continuing jobless claims, which track the number of individuals receiving benefits after an initial week of aid, declined on a seasonally adjusted basis. This indicator is often seen as a proxy for hiring, providing a forward-looking metric. These economic indicators suggest the success of the US Federal Reserve’s strategy to curb inflation without triggering a recession. The Fed has maintained its benchmark overnight interest rate in the 5.25%-5.50% range since 2023, but analysts anticipate two to three rate cuts by the end of 2024.

Technical Outlook

BITCOIN

After correcting almost 27% from the recent highs, Bitcoin reached a low of $53,485. The asset didn’t break the crucial support level of $52,000 and the lower longer shadow indicated buying at these levels. Post this move, BTC started to consolidate between $56,500 to $59,700. It finally gave a breakout above the psychological resistance of $60,000 and rallied up to $68,474. The asset has strong resistance at $70,000 and $73,777. Once it breaks and sustains above these levels then we may expect the prices to further rally. $66,000 and $60,000 will act as a strong support for BTC.

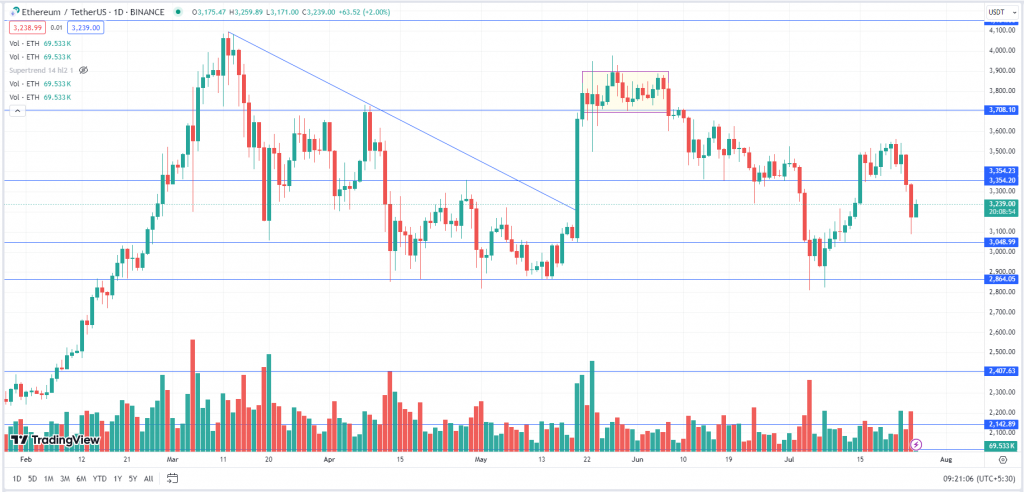

ETHER

On the daily time frame, ETH had taken multiple supports around $2,850. This time too the lower longer shadow around $2,850 indicated buying at these levels and the prices surged up to $3,560. Post this move, ETH started to consolidate between $3,500 and $3,350. The asset finally gave a breakout on the downside and dropped to $3,130. It has a strong support zone from $3,100 to $3,050. If It holds and sustains above these levels then we may expect the bulls to resume the up move. $3,500 and $3,750 will act as a strong resistance.

BNB

BNB after making the new all-time high of $721 witnessed a sharp correction as it failed to give a weekly close above the previous all-time high of $691. The prices corrected almost by 36.5% and dropped to $455. The asset has bounced back above $500 and the lower longer shadow below $500 indicates buying at these levels. BNB has a strong resistance at $600. If it breaks, sustains and closes above the resistance then we may expect it to further rally up to $650.

Weekly Snapshot:

| USD ($) | 18 Jul 24 | 25 Jul 24 | Previous Week | Current Week | |||

| Close | Close | % Change | High | Low | High | Low | |

| BTC | $63,974 | $65,777 | 2.82% | $66,067 | $56,590 | $68,480 | $63,329 |

| ETH | $3,426 | $3,174 | -7.36% | $3,516 | $3,049 | $3,560 | $3,089 |

| BNB | $571.95 | $570.71 | -0.22% | $587.40 | $517.99 | $605.19 | $554.76 |

| Crypto | 1w – % Vol. Change (Global) |

|---|---|

| BitCoin (BTC) | 10.93% |

| Ethereum (ETH) | 23.52% |

| Binance Coin (BNB) | 7.28% |

| Resistance 2 | $73,777 | $3,750 | $1.00 | $650 |

|---|---|---|---|---|

| Resistance 1 | $70,000 | $3,350 | $0.75 | $600 |

| USD | BTC | ETH | Matic | BNB |

| Support 1 | $66,000 | $3,050 | $0.6 | $545 |

| Support 2 | $60,000 | $2,850 | $0.5 | $500 |

Market Updates:

- The Donald Trump re-election campaign has raised around $3 million in crypto donations since May 2024. This is according to Q2 filings from the Federal Election Committee.

- Marathon Digital Holdings has acquired $100 million worth of Bitcoin over the past month. The world’s largest Bitcoin miner has been acquiring BTC as a strategic treasury reserve asset.

- A preliminary investigation of the July 18th WazirX crypto exchange hack did not find “any evidence that WazirX signers’ machines were compromised,” according to a July 25th report from the exchange’s team.

If you found this blog useful, share it with other like-minded crypto enthusiasts. Click on the button below to begin your crypto trading journey using ZebPay.