Bitcoin mining has long been portrayed as an energy-intensive process at odds with global sustainability goals. Headlines often frame it as a growing environmental burden, one that consumes electricity without contributing meaningfully to society’s transition toward cleaner energy systems.

But this narrative is increasingly incomplete.

Over the last few years, bitcoin mining has undergone a quiet but structural transformation, one that places it closer to renewable energy markets than traditional industrial energy consumers. The real question today is no longer whether bitcoin mining uses electricity, but whether its unique energy demand model can actually help expand renewable electricity capacity.

To answer that, we need to move beyond opinions and examine data, incentives, and real-world outcomes.

Bitcoin Mining’s 55% Shift Toward Sustainable Energy

One of the most overlooked developments in the bitcoin mining debate is how quickly its energy mix has changed.

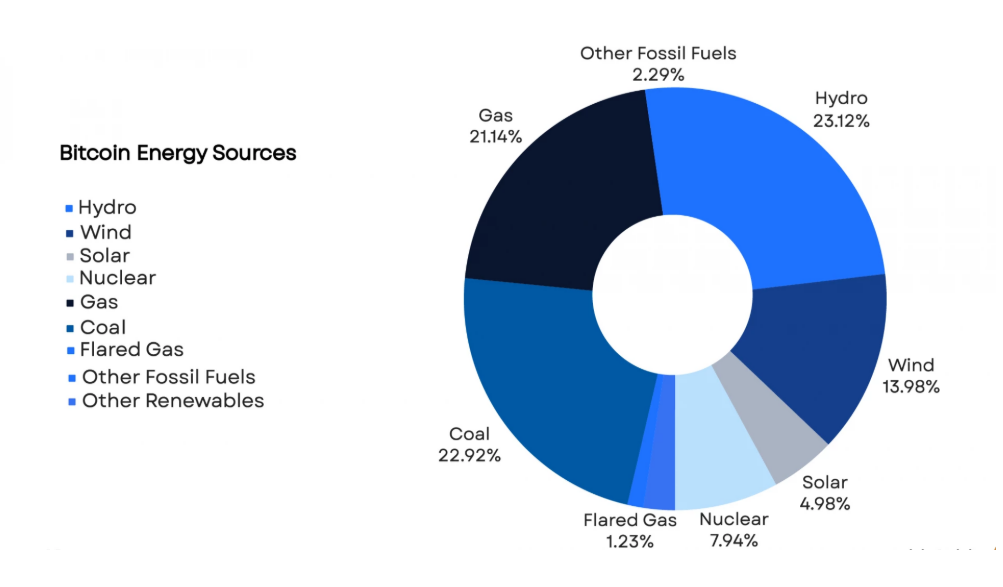

According to the Cambridge Centre for Alternative Finance (CCAF), 52.4% of global bitcoin mining energy now comes from sustainable sources, up significantly from 37.6% in 2022. This sustainable share includes:

- 42.6% renewable energy, primarily hydropower, wind, and solar

- 9.8% nuclear energy, which is low-carbon but often excluded from renewable classifications

This shift is notable not just because of its scale, but because it occurred in a relatively short time frame. Few energy-intensive industries, whether steel, cement, or data centers, have transitioned their energy mix this rapidly without regulatory mandates.

What’s driving this change is not environmental altruism alone, but a convergence of economics, grid dynamics, and long-term survival incentives within bitcoin mining itself.

Read more: What is Bitcoin? Bitcoin White Paper, Mining, and Use Cases

How Much Power Does Bitcoin Mining Actually Consume?

Understanding bitcoin mining’s environmental impact requires putting its electricity usage into perspective.

Data from the Cambridge Bitcoin Electricity Consumption Index (CBECI) estimates that the Bitcoin network consumed approximately 20.45 gigawatts (GW) of power in March 2024. Meanwhile, CoinMetrics reported an estimated 19.6 GW at the end of January 2024. Over roughly two years, the network’s estimated electricity demand has doubled.

Image Source: Batcoiz

At first glance, these numbers seem large, and they are. However, context matters.

Bitcoin mining accounts for less than 0.3% of global electricity consumption, a fraction compared to energy use by residential cooling, industrial manufacturing, or traditional data centers. More importantly, bitcoin mining differs fundamentally from most industrial energy consumers in one critical way: flexibility.

Bitcoin miners can locate anywhere, consume electricity at variable times, and shut down operations within seconds, capabilities that make them unusually compatible with renewable-heavy grids.

Why Bitcoin Mining Faces Environmental Criticism?

Despite improvements in energy sourcing, bitcoin mining continues to face legitimate environmental scrutiny, and credible research supports this concern.

A 2025 study published in Scientific Reports found that bitcoin mining still has negative impacts on environmental sustainability, particularly in regions with fossil fuel-dominated energy grids. The study concluded that while renewable adoption is increasing, it has not yet fully mitigated adverse environmental effects, especially in high energy-consumption scenarios.

However, the same research also highlights a critical nuance:

Bitcoin mining holds significant potential to support the energy transition, especially when paired with policies that encourage renewable integration, grid responsiveness, and sustainable mining practices.

In other words, bitcoin mining is not inherently incompatible with sustainability, but its impact depends heavily on how and where it is deployed.

Why Bitcoin Mining and Renewable Energy Fit Together?

Renewable energy systems face a structural challenge that is rarely discussed outside energy economics circles, like overproduction and curtailment.

Solar and wind power often generate electricity when demand is low or when grid infrastructure cannot absorb excess supply. As a result, large amounts of renewable energy are either wasted or sold at negative prices.

Bitcoin mining thrives under exactly these conditions. Because miners can operate anywhere and scale consumption up or down instantly, they can act as a flexible demand layer for renewable grids, absorbing surplus electricity that would otherwise go unused.

This flexibility fundamentally changes how renewable projects can be financed and deployed.

Bitcoin Mining as a “Buyer of Last Resort”

In energy markets, a buyer of last resort provides guaranteed demand when traditional consumers cannot absorb supply. Bitcoin mining increasingly plays this role for renewable energy producers.

By colocating mining operations near renewable generation sites, miners help stabilize revenue streams during periods of excess production. This improves project economics, particularly for early-stage or remote renewable installations that struggle with grid access.

Over time, this dynamic can make renewable projects more attractive to investors, accelerating new capacity deployment rather than merely redistributing existing energy.

How Bitcoin Mining Is Actively Adopting Renewable Energy?

Bitcoin mining’s transition toward sustainable energy is not theoretical; it is being implemented operationally across multiple regions.

Mining companies are redesigning infrastructure to align with clean energy availability, grid constraints, and long-term power contracts. These shifts are driven by economics as much as environmental considerations.

Several approaches now define how bitcoin mining integrates with renewable energy systems:

- Hydropower integration:

Miners increasingly colocate operations near hydropower facilities, especially in regions with seasonal overcapacity where electricity would otherwise be curtailed. - Wind and solar co-location:

Wind- and solar-powered mining facilities operate alongside generation sites, monetizing surplus electricity during off-peak demand periods. - Hybrid energy systems:

Some miners combine renewables with battery storage, allowing operations to remain flexible while reducing reliance on fossil-based backup power. - Grid-responsive mining:

Mining facilities increasingly participate in demand-response programs, shutting down during peak demand to stabilize grids.

Together, these models reflect a shift from extractive energy consumption to energy-market participation.

Key Developments Reshaping Sustainable Bitcoin Mining

The sustainability narrative around bitcoin mining has evolved due to several structural developments within the industry.

Technological and market-driven improvements have significantly reduced energy intensity per unit of computational power. At the same time, institutional scrutiny has raised expectations around transparency and environmental performance.

Key developments include:

- Hardware efficiency gains:

Modern mining equipment is over 60% more energy-efficient than models used in the late 2010s, reducing electricity per hash. - Institutional capital pressure:

Publicly listed mining companies increasingly disclose energy mix and carbon intensity to meet investor expectations. - Energy-first site selection:

New mining operations prioritize energy availability and sustainability over short-term electricity pricing. - Exploration of nuclear energy:

Pilot projects are evaluating nuclear-powered mining as a low-carbon, stable baseload solution.

These changes suggest bitcoin mining is evolving into a more mature, infrastructure-aware industry.

Why Bitcoin Miners Are Choosing Renewable Energy

The move toward renewable energy is not driven by ideology; it is driven by necessity. Energy costs represent the largest operational expense for bitcoin miners. As mining rewards decrease over time due to halvings, profitability increasingly depends on long-term energy strategy, not short-term arbitrage.

Renewable energy offers several advantages that fossil fuels struggle to match:

- Cost stability:

Long-term power purchase agreements (PPAs) with renewable producers reduce exposure to fuel price volatility. - Regulatory resilience:

Renewable-powered mining operations face lower regulatory risk as governments tighten emissions standards. - Operational reliability:

Renewable-rich regions often provide surplus power during off-peak hours, improving uptime and efficiency. - Capital access:

Sustainable mining models align better with ESG-focused investors and institutional funding channels.

These incentives make renewable energy not just preferable, but increasingly essential, for competitive mining operations.

How Economic Incentives Support Sustainable Mining Growth?

One of the least discussed aspects of bitcoin mining is how its demand model influences energy investment decisions.

Renewable projects often face uncertainty during early deployment stages due to fluctuating demand and grid limitations. Bitcoin mining can act as an anchor customer, absorbing excess supply and stabilizing revenues.

This creates a positive feedback loop:

- Renewable capacity expands

- Excess electricity is monetized through mining

- Project economics improve

- Additional capacity becomes financially viable

Under the right regulatory frameworks, this dynamic can accelerate renewable electricity capacity rather than simply reallocating existing energy.

Can Bitcoin Mining Increase Renewable Electricity Capacity?

The evidence suggests that bitcoin mining can contribute to renewable capacity growth, but only under specific conditions.

Mining operations aligned with clean energy, grid responsiveness, and transparent reporting can support renewable expansion. Conversely, fossil-heavy, unregulated mining undermines this potential.

Bitcoin mining is not a climate solution, but it can become a supportive tool within a broader energy transition strategy.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom. Get started today and join 6 million+ registered users to explore endless features on ZebPay!

FAQs

Can bitcoin mining help increase renewable electricity capacity?

Yes, bitcoin mining can support renewable electricity capacity by consuming surplus power from solar, wind, and hydropower projects that would otherwise be wasted, improving project economics and encouraging new capacity.

What percentage of bitcoin mining uses renewable or sustainable energy?

Around 52.4% of global bitcoin mining energy comes from sustainable sources, including 42.6% renewables and 9.8% nuclear, according to the Cambridge Centre for Alternative Finance.

How much electricity does Bitcoin mining consume worldwide?

The Bitcoin network consumed approximately 20.45 GW of electricity in March 2024, based on estimates from the Cambridge Bitcoin Electricity Consumption Index.

Why is Bitcoin mining criticized for its environmental impact?

Bitcoin mining is criticized due to its high energy use and historical dependence on fossil fuels in some regions, which can increase carbon emissions where clean energy is limited.

Why are bitcoin miners shifting toward renewable energy?

Miners prefer renewable energy because it offers lower long-term costs, stable pricing, reduced regulatory risk, and better alignment with sustainability standards.