1inch was launched in 2019 with a goal of helping users find the best prices on assets across decentralized exchanges. Within 2 years, 1inch has become one of the widely used decentralized exchanges with over $290 million locked in their liquidity pool.

Today, the 1inch network is a collection of decentralized protocols with a DeFi aggregator and an Automated Market Making protocol or AMM.

The DeFi aggregator protocol promises the best price on an asset using an algorithm called Pathfinder. Crypto assets have different prices on the different decentralized exchanges (DEXs) where they are traded. 1inch splits one trade into multiple parts and executes them on different DEXs to make use of this price difference and come up with the best final price.

An AMM is a smart contract where users can deposit their tokens, creating a liquidity pool. Unlike centralized exchanges, which use an order book, liquidity pools work without the need of an order book. Most decentralized exchanges like Uniswap, Aave, Compound etc. work on this model.

One other function of the 1inch network is lowering transaction fees. Most DEXs are built on the Ethereum network. When demand surges, transaction fees (gas fees) on Ethereum can be more than the transaction itself. A $10 transaction can have a transaction fee of $20 or more.

To solve the high fee problem, 1inch introduced Chi Gastokens. Chi Gastokens are backed by the Ethereum gas fee price and make use of Ethereum’s storage refund to provide lower fees for 1inch users.

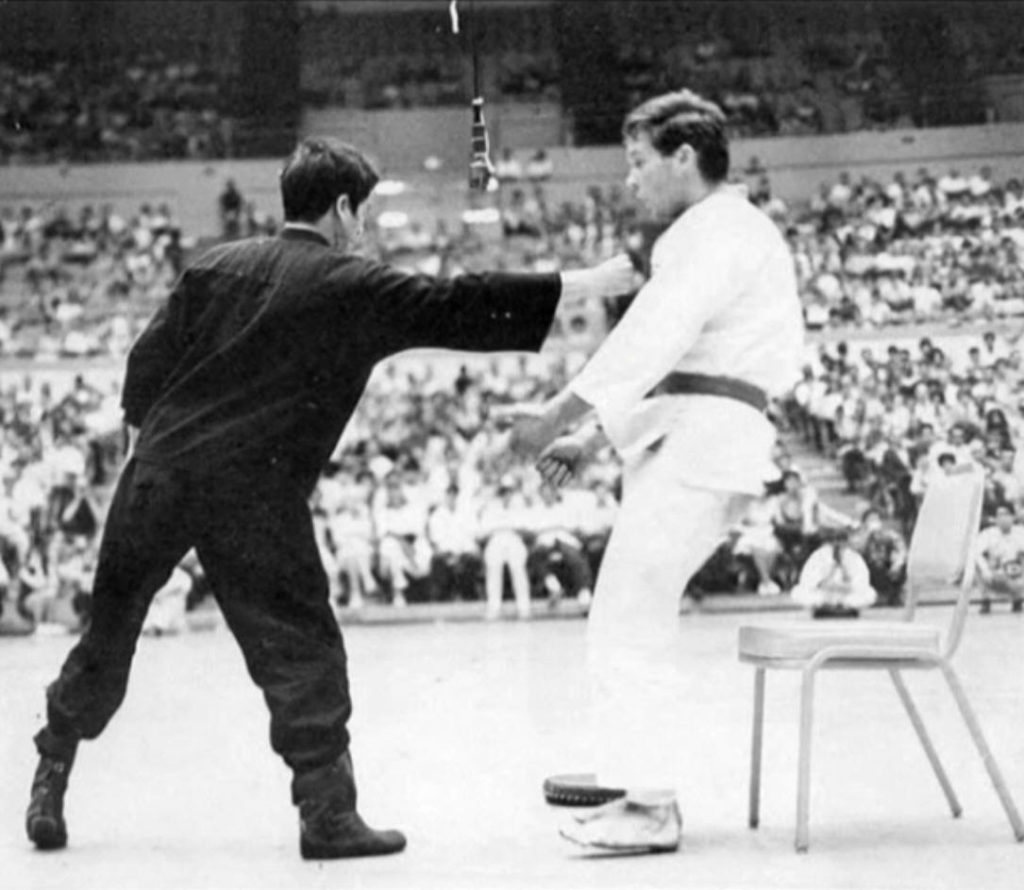

The name 1inch is inspired by Bruce Lee’s legendary “1-inch Punch”. The team aims at making the network the 1-inch punch of the crypto industry with their efficiency. “Chi/Qi” is the word for power in Asian martial arts and Chi Gastokens give users the power to execute this 1-inch punch in the cryptomarket.

1inch tokens were officially launched on Christmas Day of 2020 with a surprise airdrop of 90 million tokens to all test users who had made a trade on 1inch before September 15th 2020.

1inch tokens are used as a governance token and as utility token on the AMM and the aggregator. The 1inch community sees these tokens as an instrument to build a decentralized and permissionless network. The 1inch DAO governance protocol introduced “instant governance”, where token holders can vote on proposals with no entry barrier.

1inch tokens are mainly used to:

- Ensure that interactions with the protocols are permissionless

- Allocate funds for development activities on the ecosystem

- Incentivize users to participate in governance and other functions

- Ensure network security though staking.

1inch has worked to create a better user experience with a simple UI and expanded their services to the Binance Smart Chain (BSC) in addition to Ethereum network. 1inch tokens are issued on both Ethereum and BSC chains.

With the growing adoption of 1inch network, 1inch tokens are now ranked 109 with a $92.5 billion market capitalization. Starting today, you can trade 1inch (1INCH) on ZebPay!