The world of crypto trading is a realm where traditional financial metrics converge with innovative digital assets. Among these metrics, open interest has emerged as a crucial factor in understanding Bitcoin’s price dynamics. In this comprehensive article, we will delve into the intricate relationship between open interest and Bitcoin prices, exploring how they influence each other and reveal critical insights about market trends. We will support our analysis with informative charts and data, shedding light on this fascinating interplay.

Understanding Open Interest

Open interest is a term that hails from the realm of futures and options markets but has found its place in the crypto landscape. Simply put, open interest represents the total number of outstanding derivative contracts for a specific asset at any given time. It signifies the aggregate number of contracts that remain “open” and have not yet been closed through offsetting trades or delivery.

Bitcoin Futures and the Emergence of Open Interest

The advent of Bitcoin futures contracts on prominent exchanges, including the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE), marked a pivotal moment in the crypto journey. These derivatives enable traders to speculate on Bitcoin’s future price movements without owning the actual crypto. As Bitcoin futures contracts gained traction, so did the concept of open interest in the crypto world.

Read more: Bitcoin vs Altcoins

Relationship Between Open Interest and Bitcoin Prices

- Price Volatility: One of the most notable relationships between open interest and Bitcoin prices is that as open interest rises, Bitcoin’s price tends to become more volatile. This heightened volatility can create opportunities for traders to profit, but it also introduces greater risks.

- Sentiment Indicator: High open interest can be an indicator of market sentiment. When open interest increases significantly, it may suggest a growing consensus among traders about the future direction of Bitcoin’s price.

- Liquidity Impact: An increase in open interest can lead to increased liquidity in the Bitcoin market. More participants and more trading activity can contribute to smoother price discovery.

The Interplay Between Open Interest and Bitcoin Prices

Price Volatility and Open Interest

- One of the most striking observations is that an increase in open interest often correlates with heightened price volatility in the Bitcoin market. This increased volatility can provide both opportunities and risks for traders.

- A surge in open interest can trigger significant price swings. Traders actively participate in these moments, aiming to capitalize on market movements.

Market Sentiment and Open Interest

- Open interest can serve as a valuable indicator of market sentiment. When open interest experiences substantial growth, it may suggest a consensus forming among traders about the direction of Bitcoin’s price.

- A rising open interest figure may indicate increasing optimism or pessimism in the market. Traders interpret this sentiment to make informed trading decisions.

Liquidity and Open Interest

- As open interest expands, the Bitcoin market usually experiences improved liquidity. A larger number of market participants and higher trading volumes contribute to smoother price discovery.

- This increase in liquidity can make it easier for traders to execute orders at desired price levels, reducing slippage.

Read more: Bitcoin Price Prediction

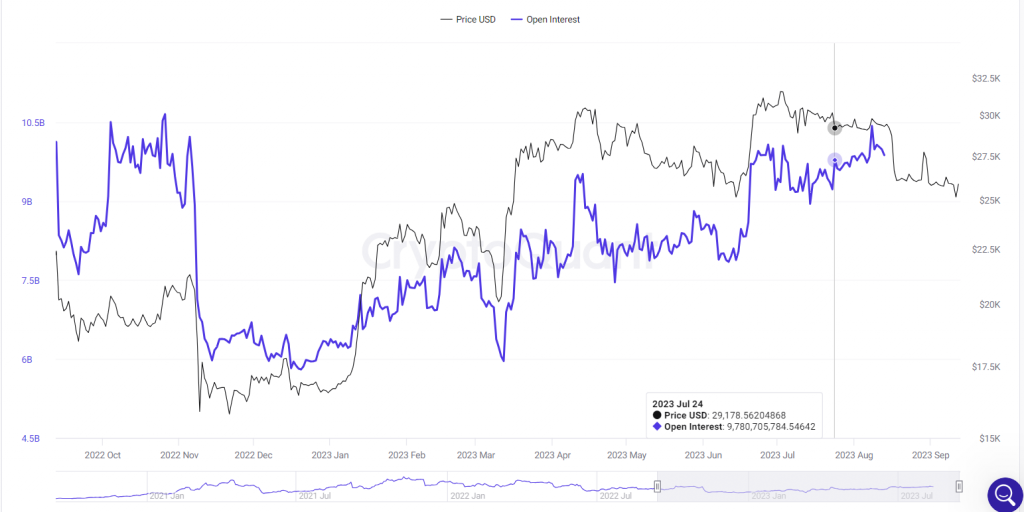

Historical Bitcoin Price vs. Open Interest

Price Surge and Rising Open Interest

Imagine that Bitcoin’s price has been steadily increasing over a few weeks. As the price climbs, more traders become interested in the crypto, leading to an increase in trading activity. This heightened interest in Bitcoin prompts more investors to enter the futures market to speculate on its future price.

As a result,

- Open interest in Bitcoin futures contracts starts to rise significantly.

- The influx of new long positions (betting on a price increase) leads to a substantial increase in open interest.

- The higher open interest indicates a growing consensus among traders that Bitcoin’s price will continue to rise.

- This growing confidence and increased trading activity contribute to further upward pressure on Bitcoin’s price.

Bitcoin Price Correction and Declining Open Interest

Now, consider a scenario where Bitcoin’s price experiences a sharp correction after reaching an all-time high. As the price starts to decline rapidly, traders who had opened long positions (betting on a price increase) begin to see potential losses. To mitigate these losses, some of these traders decide to close their positions by selling their contracts.

As a result,

- Open interest in Bitcoin futures contracts begins to decrease as traders close their positions.

- The decline in open interest reflects a shift in sentiment from bullish to bearish, as traders anticipate further price drops.

- Decreasing open interest suggests that traders are less confident in Bitcoin’s immediate price prospects.

- This reduced confidence and a decrease in trading activity may contribute to further downward pressure on Bitcoin’s price.

Bitcoin Price Consolidation and Stable Open Interest

In a scenario where Bitcoin’s price enters a period of consolidation, where it hovers within a relatively narrow price range for an extended period, open interest can also provide insights. During price consolidation, open interest may remain relatively stable, neither increasing nor decreasing significantly. This stability in open interest suggests that traders are unsure about the direction in which Bitcoin’s price will move next. Once Bitcoin’s price breaks out of the consolidation range, open interest may respond accordingly, either increasing or decreasing based on the direction of the breakout.

The relationship between open interest and Bitcoin prices represents a multifaceted interplay that continues to evolve as the crypto market matures. While surging open interest often signals market sentiment and provides liquidity, it also introduces the potential for increased price volatility.

As crypto markets remain dynamic and ever-changing, market participants must monitor open interest alongside other fundamental and technical indicators. While the charts and data provided here offer valuable insights, they should be considered within the broader context of market analysis.

In the end, the intricate dance between open interest and Bitcoin prices is a testament to the crypto market’s sophistication and the myriad factors at play. By understanding this relationship and staying vigilant in their analysis, traders and investors can navigate the exciting world of Bitcoin trading with greater confidence and insight.