04th October 2023| ZebPay Trade-Desk

The crypto industry is undergoing a surge of excitement and innovation, with numerous platforms and projects harnessing the potential of blockchain technology. However, amid the genuine game-changing developments, there are several projects that never live up to their promises. Unfortunately, newcomers are frequently the ones who suffer the consequences, falling prey to deceptive and overhyped projects. By gaining a deeper understanding of the crypto landscape and its intricacies, individuals can avoid common pitfalls and steer clear of the traps often set for newcomers. In this article, we explore some of the typical tactics employed by weak or deceptive crypto projects to deceive newcomers.

Significant Supply Inflation

In the realm of crypto assets, the majority exhibit some level of inflation. This inflation occurs as new tokens are either freshly created or unlocked and distributed to various participants and stakeholders within the network over time. Inflation serves several purposes, including the reinforcement of security in Proof-of-Work and Proof-of-Stake networks by rewarding miners and node operators. It can also act as a continuous source of funding to support long-term development and other legitimate needs.

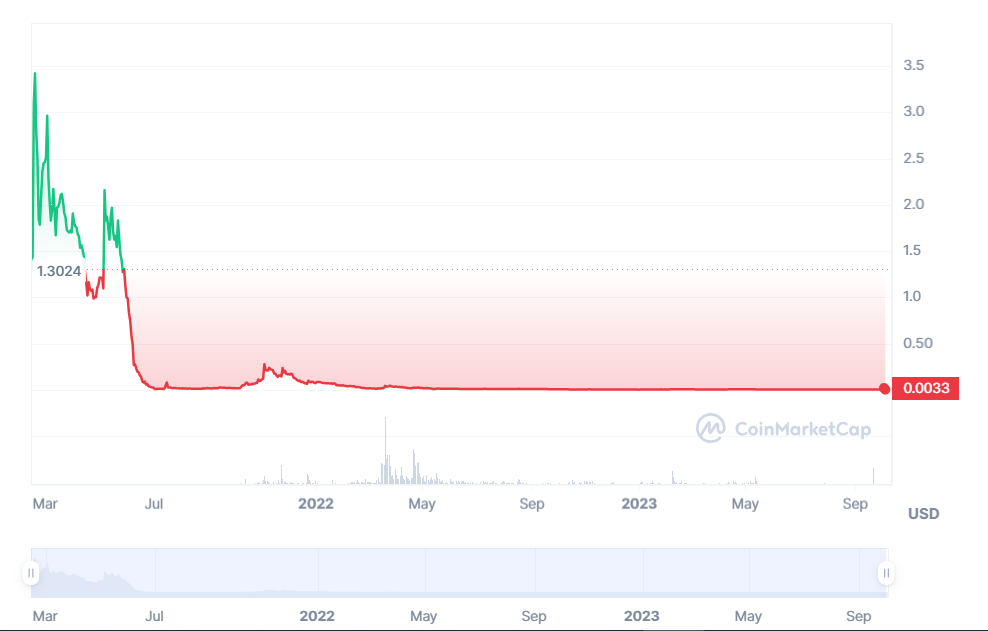

While most established projects experience inflation at a reasonable rate – the top 10 Proof-of-Stake networks have an average inflation rate of about 7.7% per year – some undergo an excessive level of inflation. This creates a substantial disparity between supply and demand, which can severely impact the token’s value. This trend is often observed in newly launched projects. Typically, only a tiny fraction of the total token supply is unlocked during the token generation event (TGE). These projects tend to have an exceptionally low market capitalization, often falling below $100,000, but immediately experience an alarming rate of inflation post-launch. This frequently results in a distinct chart pattern characterized by an initial price surge followed by a near-constant decline as excessive inflation dampens demand.

Read more: Proof of Work vs Proof of Stake

Regrettably, numerous newly established projects employ a series of marketing strategies to ignite an initial surge of excitement surrounding their token. However, this enthusiasm is almost always short-lived, eventually succumbing to significant selling pressure as early investors, who have seen their investments appreciate, seek to liquidate their holdings. Due to a lack of comprehension regarding the distinction between initial market capitalization and fully diluted value, a substantial portion of investors become ensnared in overhyped projects. Most of these investors have limited experience dealing with early-stage projects.

Read more: What is a Crypto Scam

Early Bird Pricing

The vast majority of projects are either entirely or almost entirely funded by early-stage investors, which can include VCs, angel investors, exchange partners, incubators, and other types of funds. In most cases, a large proportion of the token supply is sold to early-stage investors at a significant discount compared to the public price. Prior to launch, projects often sell a small fraction of the supply to public sale participants who are typically expected to help promote the project among their networks. It’s not uncommon for early-stage investors to receive discounts exceeding 70% compared to public buyers.

When the project eventually lists on an exchange, the anticipation is that retail buyers will step in to support the price, allowing early-stage investors to exit their positions at a profit. In some instances, early-stage investors can recover their entire initial investment on the first day, despite usually being subject to a vesting schedule and receiving only 10-20% of their tokens at the Token Generation Event (TGE). Although some projects are transparent about the discounts early investors receive, others obscure the prices paid by seed and private sale investors for their tokens, making it challenging to discern the markup faced by public participants.

However, it’s worth noting that many higher-quality projects are discerning about who can participate in their earliest fundraising rounds, typically favouring investors who can provide value beyond capital, such as assistance with growth, marketing, user acquisition, development, etc. In such cases, the discount may be considered justifiable. Generally, the best way to avoid falling victim to this type of scam is to exercise caution and scepticism when encountering random airdrops. These are often associated with crypto phishing or hacking attempts and can be easily avoided by ignoring them.

Manipulation of Market Makers

Several projects hire market makers to ensure that a market maintains enough liquidity. While this practice can benefit a project, it can also be used to deceive new traders. Market makers are often instructed to keep the token’s price within a specific range by buying tokens when the price drops too low and selling them when it rises too high. This can create the illusion of a healthy, stable market and even generate bullish chart patterns like bull flags. However, this manipulation is typically short-lived because projects often only hire market makers for a limited time. Once their involvement ends, the token’s natural price trajectory, which may be negative, becomes more apparent.

This manipulation is particularly concerning for newly launched tokens, as market maker activity can obscure a token’s true price action, making it difficult to determine if it’s a genuinely attractive investment. Therefore, newcomers to the crypto space should focus on a project’s fundamentals rather than short-term price movements when market maker involvement is suspected.