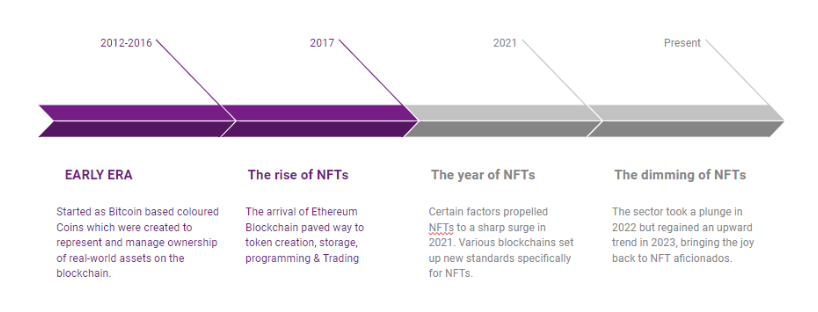

While 2021 was recognized as the year of Non Fungible tokens (NFTs), it is essential to note that the technology itself was not newly invented during this time. In 2014, Kevin McCoy created the first NFT named “Quantum” on the Namecoin blockchain. However, the concept that paved the way for NFTs started earlier with the introduction of Bitcoin-based coloured coins in 2012–2013. Meni Rosenfield’s paper in 2012 contributed to this idea, leading to the development of BRC-20 tokens on the Bitcoin blockchain.

It was in 2017 that NFTs gained widespread attention, primarily because of the introduction of the Ethereum blockchain. Ethereum addressed the limitations of earlier blockchains in hosting NFTs and provided a reliable solution for essential functions like token creation, storage, programming, and trading. Additionally, Ethereum significantly lowered the barriers for launching NFT projects, making it more accessible to a broader audience.

The timeline of NFTs

A significant advancement in Bitcoin’s capabilities was showcased through coloured coins, which represented tiny fractions of a Bitcoin, even as small as a satoshi. These coloured coins demonstrated various use cases, such as representing property, coupons, digital collectibles, subscriptions, shares, and access tokens, highlighting the potential of blockchains for issuing assets.

Although coloured coins showed promise, Bitcoin was not originally designed to function as a database for tokens, leading to coloured coins remaining mostly at the conceptual stage. However, their development sparked a series of experiments that eventually led to the creation of Non Fungible tokens (NFTs). The first NFT, “Quantum,” mentioned earlier, was an octagon-shaped animation. The introduction of Ethereum provided NFTs with the ideal platform they needed to thrive and evolve into the vibrant ecosystem they are today.

During this period, The Counterparty platform played a crucial role in enabling the development of digital assets. It operated on the Bitcoin blockchain and facilitated the creation and trading of various assets. One notable project that emerged on The Counterparty platform was the release of a collection of Non Fungible tokens (NFTs) known as “Rare Pepes.” These NFTs marked the beginning of using NFTs as digital artworks, where each token represented a unique and collectible piece of artwork.

Another significant NFT project that followed The Counterparty was “Spells of Genesis,” which was built on the Ethereum blockchain. This project further demonstrated the potential and versatility of NFTs by offering unique in-game assets and collectibles. These early NFT projects paved the way for the widespread adoption and growth of the NFT space, as it expanded beyond art into various industries and applications.

After the success of Rare Pepes, Larva Labs introduced CryptoPunks, a generative series of NFTs inspired by London punk culture. With 10,000 unique and distinct characters, CryptoPunks quickly gained popularity and served as the foundation for many other NFT projects, including the well-known Bored Ape Yacht Club. Following CryptoPunks, CryptoKitties emerged during the ETHWaterloo hackathon in October 2017. This NFT game allows players to buy, sell, and create NFTs representing virtual cats with different desirable traits on the Ethereum blockchain. The success of CryptoKitties sparked a surge in NFT gaming.

The combination of NFT gaming and metaverse projects brought a new wave of momentum. One prominent project during this time was Decentraland, an Ethereum-based virtual world that enabled players to explore games and collect assets. In October 2018, Axie Infinity, an NFT-based battle game, was introduced, becoming a pioneer in the play-to-earn (P2E) gaming concept. In Axie Infinity, players engage in battles using unique and rare NFT creatures called Axies, which have distinct attributes. Gamers can earn in-game rewards while playing and have the ability to build and enhance their Axies with additional attributes. Axie Infinity’s success further propelled the adoption of NFTs in the gaming industry.

In 2021, the NFT market experienced a remarkable surge in both supply and demand, with NFT trading volume increasing by around 21,000% to reach a staggering $17 billion, according to NonFungible.com, a data company specialising in NFTs.

The art market played a significant role in driving this surge, as NFTs provided a new platform for artists to showcase and store their digital art with verifiable authenticity. The rise of digital art gained momentum and contributed to the overall NFT boom.

Renowned auction houses like Christie’s and Sotheby’s also embraced NFTs, moving their auctions online and featuring NFT art, which further boosted the popularity of NFTs. A significant moment during this period was the record-breaking sale of Beeple’s “Everydays: the First 5000 Days” NFT at Christie’s, which fetched a staggering $69 million. This high-profile sale attracted attention from various blockchain enthusiasts and prompted interest in NFTs beyond the Ethereum network.

The NFT frenzy inspired other blockchains like Cardano, Solana, Flow, and Tezos to develop their own NFT platforms. In September 2021, smart contracts became operational on Cardano, paving the way for NFT applications on the network. Several blockchains established new standards to ensure the authenticity of nonfungible assets. Another significant event of the year was Facebook’s rebranding as Meta, signalling its entry into the metaverse space. NFTs have been an integral part of the metaverse concept, leading to increased demand and interest in NFTs.

Read more: Crypto vs NFTs

Throughout much of 2022, the NFT sector experienced a period of stagnation, largely influenced by macroeconomic factors that dampened enthusiasm in the market. The metaverse, which had previously been a hot topic, also lost some of its appeal, as evidenced by Mark Zuckerberg’s metaverse division suffering significant losses in 2022, amounting to $13.72 billion.

However, 2023 brought a renewed sense of optimism to NFT enthusiasts. In January, Bitcoin Ordinals launched, taking advantage of the Bitcoin Taproot upgrade from 2021, which enabled on-chain Bitcoin-native NFTs. Following this, Yuga Labs, a leading issuer of NFTs, announced “TwelveFold,” a new NFT collection to be issued on the Bitcoin network.

The NFT market experienced substantial growth in 2023, with the total trading volume reaching $2 billion in February, a 117% increase from the previous month. This momentum continued into March, where there was only a slight dip in trading volume. Market analysts project further growth in the NFT sector, with BCC Research estimating a market value of $125.60 billion by 2027, showcasing a compound annual growth rate of 27.7% between 2022 and 2027.

Data from DappRadar and Dune revealed that around 5.8 million NFTs were sold in March, compared to approximately 6.5 million in February. Ethereum remained the dominant platform for NFT trading, with trading volumes in February and March almost identical at $1.81 billion and $1.82 billion, respectively.