Bitcoin has been making a sustainable ascent since the start of 2023. Bitcoin’s price on Jan 1st 2023 was at approximately $16,500 and as of 15th Feb 2024, it is trading at close to $52200. This remarkable rise of 215% is a testament to the robustness of Bitcoin and shows us how it can weather any storm.

As shown in the above image Bitcoin has breached major resistances at $30,000,$37,000, and $45000. While the fundamentals of Bitcoin have been the same since its inception, few macroeconomic catalysts and the increasing acceptance of Bitcoin have contributed to its tremendous growth.

The surge in activity observed in Bitcoin trading during December 2023 and January 2024 can be attributed to several factors, with a prominent one being the anticipation surrounding the introduction of Spot Bitcoin ETFs, along with the notable upward trends in other leading Altcoin values.

Since the approvals of 9 Spot Bitcoin ETFs, the asset has seen a healthy increase in price with a growing demand pressure. Spot Bitcoin ETFs have significantly broadened Bitcoin’s accessibility to retail investors. With significant institutions now actively engaged in Bitcoin, retail investors are increasingly assured of its acceptance and necessity.

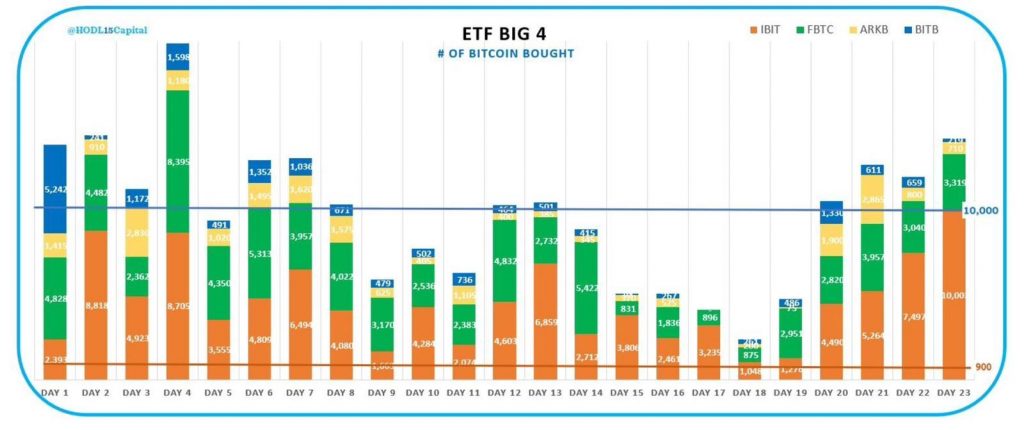

The below table is a snapshot of Bitcoins being acquired by the four largest Spot Bitcoin ETF companies since the day ETFs were launched.

With only close to 900 BTC being mined on a daily basis and the demand is far higher than the supply, the price has displayed an upward trend.

The future for Bitcoin holds bright with the growing acceptance of crypto and major events such as the Bitcoin halving around the corner.

Bitcoin halving which is likely going to happen in April is one of the most awaited events in 2024. Bitcoin halving happens every four years effectively cutting down the Bitcoin block rewards by half. This programmed reduction in block rewards is a crucial feature of Bitcoin’s deflationary framework.

In the broader context, the halving event significantly improves the supply dynamics of Bitcoin. This systematic reduction creates a potential supply pressure, a factor when coupled with ongoing market improvements, such as ETF approvals and other innovations, could stimulate demand. Consequently, this has the potential to influence crypto markets, contributing to observable price impacts.

Read more: Bitcoin Price Prediction

To know more about Crypto, Web 3.0 and Blockchain, stay tuned to ZebPay blogs. If you found this blog to be useful, do share it with other like-minded crypto enthusiasts. Click on the button below to begin your crypto trading journey using ZebPay.