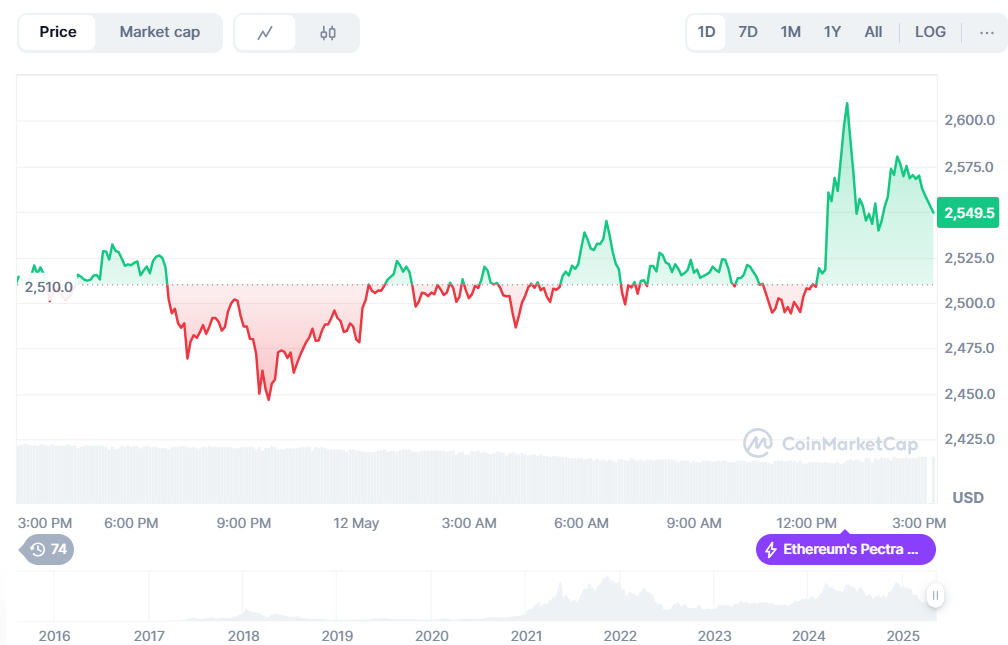

Ethereum (ETH) has recently demonstrated notable upward momentum, with its price crossing the $2,500 threshold – a development that has drawn renewed attention from investors and analysts alike. On May 12, 2025, at 1:21 PM IST, Ethereum was valued at approximately $2,555, underscoring a strong upward movement in its price. According to market reports, this surge represents more than a short-term rally; it reflects a combination of strengthening fundamentals, positive market sentiment, and broader developments within the digital asset ecosystem. This latest surge prompts a closer examination of the factors driving the price increase and potential implications for investors.

Ethereum’s Recent Price Surge: The Numbers

So far, Ethereum has posted impressive gains, reinforcing its role as a leading force in the crypto market. This surge reflects not only positive market sentiment but also growing trust in Ethereum’s long-term value and utility.

Key Highlights

- Weekly Price Growth: Ethereum’s value in USD rose by 31.3% during May’s first week.

- Price (May 11, 2025): Close to $2,575, representing an almost 11% gain on the day – its largest single-day percentage increase since May 8, 2025.

- Market Capitalization: $309.80 billion, as of May 12, 2025, at 2.53 PM IST, reinforcing Ethereum’s position as the second largest crypto asset by market cap.

- Share of Total Crypto Market: Currently, Ethereum accounts for roughly 10% of the global crypto market cap.

- Circulating Supply: 120.72 million ETH.

Ethereum’s growth trajectory highlights its role not just as a tradable asset, but as a foundational layer for decentralized applications (dApps), tokenized assets, and enterprise blockchain use cases, all of which continue to expand in both relevance and adoption.

Why Ethereum is Surging?

Ethereum’s recent upward momentum is the result of converging factors, ranging from institutional market movements to meaningful technical upgrades and ecosystem-wide growth:

- The Pectra Upgrade

A key catalyst behind Ethereum’s May rally has been the Pectra upgrade, which went live on May 7, 2025. This landmark upgrade brought a suite of enhancements focused on improving scalability, optimizing staking mechanisms, and enhancing wallet functionality:

- EIP-7251 raised the staking limit per validator from 32 ETH to 2,048 ETH, streamlining node operations and boosting staking efficiency.

- EIP-7702 introduced temporary smart contract capabilities to Ethereum wallets, enhancing their flexibility and functionality.

- Moreover, nine more Ethereum Improvement Proposals were incorporated, fortifying Ethereum’s infrastructure across both the protocol and application layers.

Following the upgrade, the ETH token surged nearly 20%, crossing the $2,100 threshold. Overall, Ethereum price has seen a 40% rise after the upgrade.

- DeFi and NFT Ecosystem Revival

Ethereum stands as the pivotal foundation driving the decentralized finance (DeFi) and non-fungible token (NFT) sectors, enabling innovation and growth within these ecosystems:

- TVL (Total Value Locked) in DeFi protocols has begun to rise again, suggesting renewed activity in lending, trading, and yield-generation platforms.

- NFT marketplaces are also showing signs of stabilization, with increased developer activity and growing interest in utility-based tokens.

This resurgence, though measured, indicates that Ethereum’s core use cases are regaining momentum as broader market sentiment improves.

- Regulatory Tailwinds and Market Recovery

Global regulatory clarity is slowly emerging, offering the crypto sector a more structured environment in which to operate. Ethereum stands to benefit from:

- Improved compliance frameworks in the U.S., Europe, and parts of Asia.

- Greater investor confidence as the asset matures within an increasingly regulated financial ecosystem.

Coupled with a general recovery in the crypto market, these regulatory developments are helping Ethereum gain further legitimacy and adoption.

What This Means for Investors?

Ethereum’s recent rally is more than a price event — it presents a moment of strategic reflection for both new and seasoned investors. Understanding the implications of this surge is crucial for making informed decisions in a market that continues to evolve rapidly.

Potential Opportunities

The growth in Ethereum’s value and utility opens several promising avenues for participation:

- Staking Rewards: With upgrades like Pectra increasing staking limits, investors can now earn rewards more efficiently by locking ETH to help secure the network.

- DeFi Participation: Ethereum serves as the core infrastructure driving the DeFi ecosystem. Protocols built on Ethereum offer avenues for lending, borrowing, yield farming, and liquidity provisioning.

- Ecosystem Expansion: Developers continue to build new applications on Ethereum, including in areas like tokenized real-world assets (RWAs), decentralized identity, and gaming, all of which present potential entry points for early adopters.

Strategies

Investors looking to gain exposure to Ethereum can consider various strategies based on their risk appetite and time horizon:

- Dollar-Cost Averaging (DCA): Spreading out purchases over time can help mitigate the impact of short-term volatility and avoid buying at market peaks.

- Long-Term Holding (“HODLing”): For believers in Ethereum’s foundational role in the future of finance and technology, a long-term position may align with the network’s multi-year growth trajectory.

- Active Trading: More experienced investors may capitalize on short-term price movements. However, this approach requires careful analysis, strict risk management, and awareness of broader market signals.

Conclusion

Ethereum’s latest rally is more than just a price movement—it signals a renewed phase of maturity and innovation for the network. Driven by the Pectra upgrade, increased institutional interest, and a rebound in DeFi and NFT activity, Ethereum is strengthening its position as both a technological backbone and an investment-worthy asset. For investors, this surge highlights meaningful opportunities in staking, DeFi, and long-term portfolio growth. Yet, it also comes with the usual caution around volatility and regulation. As Ethereum evolves, thoughtful strategies and a forward-looking approach will be key to navigating its next chapter.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom—get started today and join 6 million+ registered users to explore endless features on ZebPay!