Introduction

Blockchain as a technology emerged from Bitcoin. It changed the financial landscape by opening the possibility to innovate beyond imagination. Governments around the globe have realised both the significance as well as the utility of crypto and are coming up with their respective CBDCs. As the name suggests, CBDC (Central Bank Digital Currency) is a Central Bank-backed blockchain-based version of national currency. Bitcoin is the pioneer which led to these changes in the world. Other crypto tokens started coming up by taking inspiration from Bitcoin’s open-source code.

Pros of Investing in Bitcoin

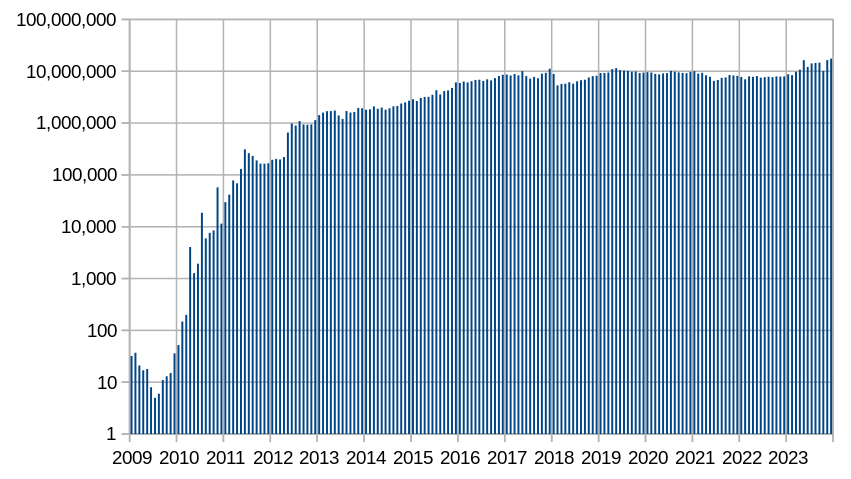

Bitcoin is the digital equivalent of gold. Since its genesis in 2008, Bitcoin’s transactions and value have greatly increased. Evaluations, market predictions, the health of the crypto market etc. are still understood by the performance of Bitcoin. The below graph captures the yearly transactions on the Bitcoin blockchain since 2009.

The following are some benefits of investing in Bitcoin

- When compared to new alternatives Coins/Tokens, Bitcoin is a safer bet to play with. Bitcoin is known to be less volatile. However, market volatility has a strong correlation with adoption and macroeconomic events and is subject to change.

- Bitcoin has been equivalent to gold in the crypto world-it has a finite supply and needs to be mined.

- With the recognition of Bitcoin by governments around the globe, Bitcoin is closer to gaining legitimacy worldwide. Taking decisions from the forefront, El Salvador has even introduced Bitcoin as a legal tender.

- Bitcoin is recognized by the whole crypto community. Holding and transacting BTC is highly facilitated worldwide.

- Bitcoin has a finite supply of 21 Million and has a protocol which reduces the supply once every four years making it deflationary.

Read more: How Can I Buy 1 Bitcoin (BTC)

Are there any Cons of Investing in Bitcoin?

Bitcoin is the first crypto asset to be followed by many others. Newer alternatives, also called altcoins, are created to solve the issues of scalability, speed, utility and security. These are created for specific purposes.

When compared with other institutional investments like stocks, Bitcoin is self-regulated. There is no centralised body to govern the price, making it a truly decentralised and global asset. While a part of the investing community believes that this is a drawback of the asset, it reinforces the fact that self-regulating systems without the need for human intervention can be built.

Read more: Crypto Investing vs Crypto Trading

A few key points to note about Bitcoin

- Bitcoin lowers the risk factor, especially when compared to altcoins as the asset is more decentralised and the price movements are closer to ideal market scenarios

- Unlike investing in financial institutions, Bitcoin is self-regulated

- As altcoins have come up with upgraded technologies and utilities, Bitcoin is not widely used in building applications. While Bitcoin is predominantly used as a store of wealth, recent innovations like Ordinals have opened the possibility to innovate using the Bitcoin blockchain.

Read more: Why Is Bitcoin’s Price Rising

Is it Smart to invest in Bitcoin 2024 – 2025?

Bitcoin enthusiasts often make overly optimistic predictions for the crypto, with some suggesting it could reach $1 million in the next few years. Standard Chartered Bank raised its prediction for Bitcoin’s price to $1,00,000 to $1,20,000 by 2024, citing increased profits for miners. Chinese-Canadian entrepreneur Samson Mow believes Bitcoin could hit $1 million in five years. Balaji Srinivasan, an investor and former Coinbase executive, bet that Bitcoin could reach $1 million in just 90 days, citing potential hyperinflation weakening the dollar. However, many crypto experts believe such extreme predictions are unrealistic.

Please note that the above-mentioned data points are not investment recommendations. Investors are required to conduct their thorough research before investing in any crypto-related asset.

Irrespective of the price predictions of the asset, the fundamentals of Bitcoin remain incredibly robust. This makes Bitcoin an investing tool which can weather the storms and survive the ups and downs of market movements. The protocol of the Bitcoin blockchain which is a self-regulatory mechanism ensures that the asset remains deflationary and no human intervention can meddle with the functioning of the asset.

Read more: Bitcoin Price Prediction

If you found this blog to be useful, do share it with other like-minded crypto enthusiasts. Click on the button below to begin your crypto trading journey using ZebPay.