Ever wondered why your crypto transactions sometimes take forever or cost a fortune in fees? Sidechain crypto might be the unsung hero solving that. As someone dipping toes into blockchain, you’ve likely heard of Bitcoin or Ethereum struggling with “scalability,” handling thousands of users at once.

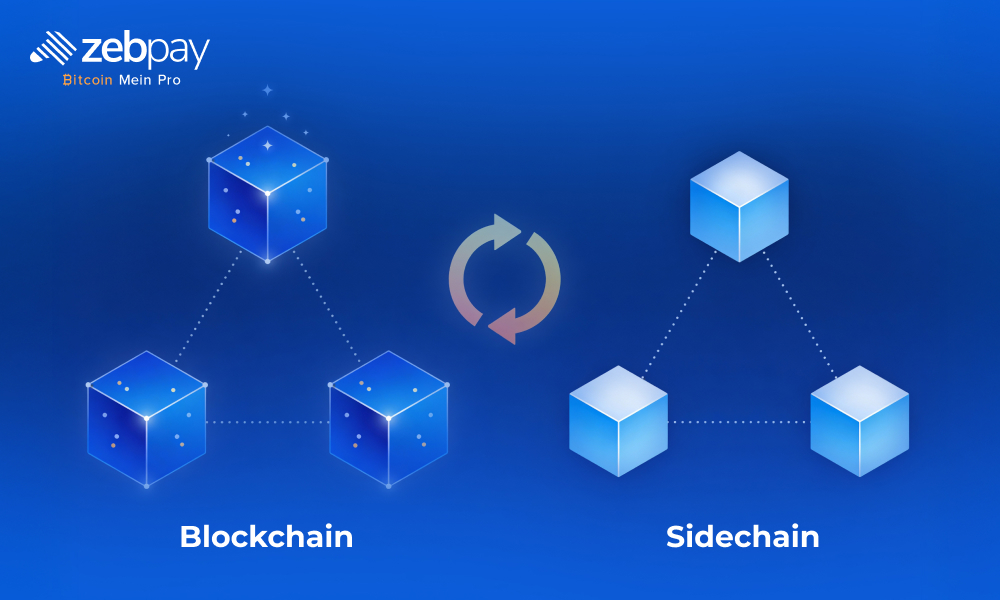

What is a sidechain crypto? It’s like a fast-lane expressway running parallel to the main highway (the primary blockchain), letting traffic flow more quickly without jamming the original road.

This guide breaks it all down, from basics to real-world use, so you can grasp how crypto sidechains make blockchain practical for everyday apps like gaming or payments. No jargon overload; just clear steps and examples.

What is a Sidechain?

Picture the main blockchain (mainchain) as a busy city center road: slow during rush hour due to traffic (transactions). A sidechain is an independent blockchain linked to this mainchain via a special “two-way bridge.” You “lock” your tokens on the mainchain, and equivalent ones unlock on the sidechain for use there, then reverse when done.

Each sidechain runs its own show: custom rules, faster block times (e.g., 1 minute vs. Bitcoin’s 10), unique consensus (like Proof-of-Stake instead of Proof-of-Work), and even its own token. Public ones are open to all; private for specific groups. Multiple sidechains can connect to one mainchain, chatting via the mainnet as a relay.

Why build one? Mainchains like Ethereum process ~15 transactions per second (TPS), Visa does 1,700+. Sidechains offload dApps (decentralized apps), experiments, or high-volume tasks, scaling without changing the mainchain’s core. First proposed by Adam Back in 2014, they’re key to blockchain’s growth.

How Do Sidechains Work?

- Two-Way Bridge Setup

To move assets (e.g., ETH from Ethereum mainchain), you initiate a “lock” transaction on the mainchain. Smart contracts verify and “peg” equivalent value on the sidechain, and cryptographic proofs ensure no double-spending.

- Operate on Sidechain

Now with sidechain tokens, transact freely: faster speeds, lower fees, custom features. Validators (nodes) secure it using the sidechain’s consensus, e.g., Delegated Proof-of-Stake for quick blocks.

- Return to Mainchain

Unlock sidechain assets; bridge releases mainchain ones after verification (may take time for safety). Plasma (Ethereum framework) uses hierarchical child chains for efficiency, with “block commitments” settling on the root chain.

Security note: Sidechains don’t inherit mainchain protection fully; they’re sovereign, so choose trusted ones. If hacked, the mainchain stays safe, but your sidechain assets risk loss. Bridges use fraud proofs or multi-sig for trust.

Sidechains vs Layer 2 Solutions

Confused by sidechain crypto vs. Layer 2 (L2)? Both scale, but differ fundamentally. L2 (rollups like Optimism) live “on top” of mainchain, inheriting its security, batching transactions off-chain, settling proofs on mainnet. Sidechains are separate networks, self-secured.

| Aspect | Sidechains | Layer 2 (e.g., Rollups) |

| Security | Independent; own validators/consensus | Inherits mainchain security |

| Dependency | Standalone; bridge for interaction | Tied to the mainchain for finality |

| Scalability | Custom params (e.g., 7,000 TPS) | Batches for high TPS, but mainchain-limited |

| Interoperability | Bridges to multiple chains | Mainly mainchain-focused |

| Use Case | Experiments, privacy, custom features | Pure scaling (e.g., DeFi on Ethereum) |

Popular Sidechain Examples

Liquid Network (Bitcoin sidechain)

By Blockstream, 1-minute blocks for fast/confidential BTC transfers. Exchanges use it for swaps; issues stablecoins. Secures via federated nodes.

Rootstock (RSK, Bitcoin sidechain)

Adds Ethereum-like smart contracts to BTC. Lock BTC for RBTC; run Solidity dApps. Merged mining with Bitcoin for security. TPS rivals Ethereum.

Polygon (Ethereum sidechain framework)

EVM-compatible; 65,000 TPS potential. Developers build custom sidechains (Plasma, zkRollups). Powers NFTs, gaming (e.g., Starbucks loyalty). MATIC/POL token for fees.

Others: SKALE (elastic sidechains, zero-gas dApps); Gnosis Chain (fast payments); Loom (gaming/social).

Benefits of Sidechains

1. Scalability Boost

Sidechains offload high-volume tasks from congested mainchains like Ethereum (15 TPS), enabling thousands of TPS for dApps and DeFi. This keeps the mainchain secure while handling mass usage.

2. Speed & Low Fees

Custom block times and consensus cut confirmations to seconds and fees to pennies vs. mainchain’s minutes and high gas costs. Perfect for micro-transactions and gaming.

3. Flexibility

Developers customize rules, consensus, or privacy without mainchain forks. Ideal for niche apps like gaming or enterprise experiments.

4. Interoperability

Two-way bridges move assets seamlessly between chains, enabling cross-chain swaps and composability. Builds interconnected ecosystems.

5. EVM Compatibility

Ethereum devs deploy Solidity contracts easily on EVM sidechains like Polygon, accelerating dApp growth. Lowers migration barriers.

Risks and Challenges

Security Risks: Sidechains self-secure without mainchain inheritance, risking validator attacks or bridge hacks ($600M+ losses historically). Mainchain stays isolated, but verify audits first.

Complexity: Bridges involve lock/unlock delays and wallet setup; liquidity fragments across chains. Test with small amounts to avoid errors.

Adoption Hurdles: Users must trust new networks; low TVL limits liquidity. Established chains like Polygon succeed via communities.

Conclusion

Crypto sidechains solve blockchain’s core pain points, scalability, speed, and cost, by running parallel to mainchains like Bitcoin and Ethereum through secure two-way bridges. From Liquid’s confidential BTC swaps and Rootstock’s smart contracts to Polygon’s high-TPS dApps, they deliver flexibility, EVM compatibility, and interoperability while L2s focus on inherited security.

Though risks like bridge vulnerabilities exist, audited projects make sidechain crypto practical for everyday use. Whether you’re trading, gaming, or building, sidechains turn blockchain from experimental to essential, your fast lane to Web3’s future.

In the grand scheme of things, ZebPay blogs are here to provide you with crypto wisdom. Get started today and join 6 million+ registered users to explore endless features on ZebPay!

FAQs

What is a sidechain crypto?

A sidechain crypto is an independent blockchain that is connected to a main blockchain, such as Bitcoin or Ethereum. Through a two-way bridge, allowing users to transfer assets between them for faster, cheaper transactions. While the sidechain handles its own security and consensus mechanism.

What are some examples of sidechains?

Popular sidechain examples include the Liquid Network for Bitcoin (fast confidential transfers), Rootstock (RSK) for Bitcoin smart contracts, and Polygon for Ethereum (high-TPS dApps and NFTs).

Are sidechains safe to use?

Sidechains can be safe when used with well-audited projects that have strong validators and secure bridges. As a mainchain compromise doesn’t affect them directly, but they carry risks like independent security vulnerabilities or bridge exploits.

Why use a sidechain for crypto transactions?

You use a sidechain for crypto transactions to achieve much faster speeds and drastically lower fees. This brings higher scalability for activities like DeFi or gaming that overwhelm mainchains.